NWP Monthly Digest | August 2021

All Eyes Are on the Delta

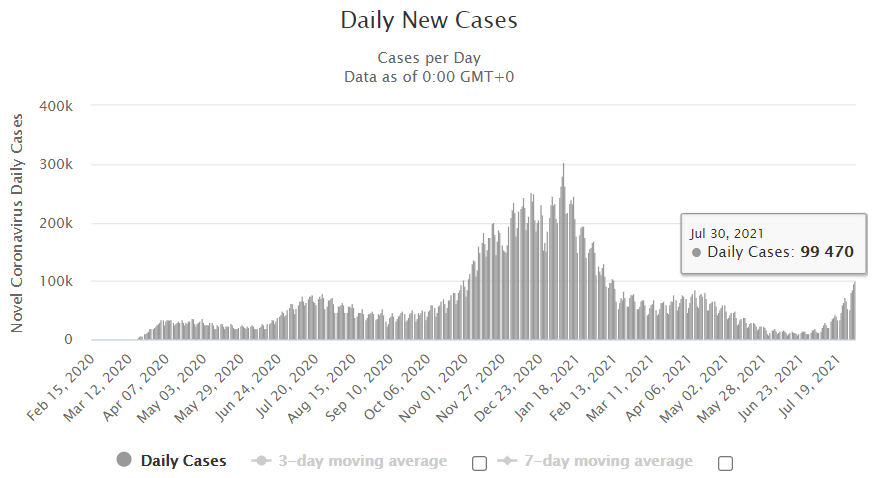

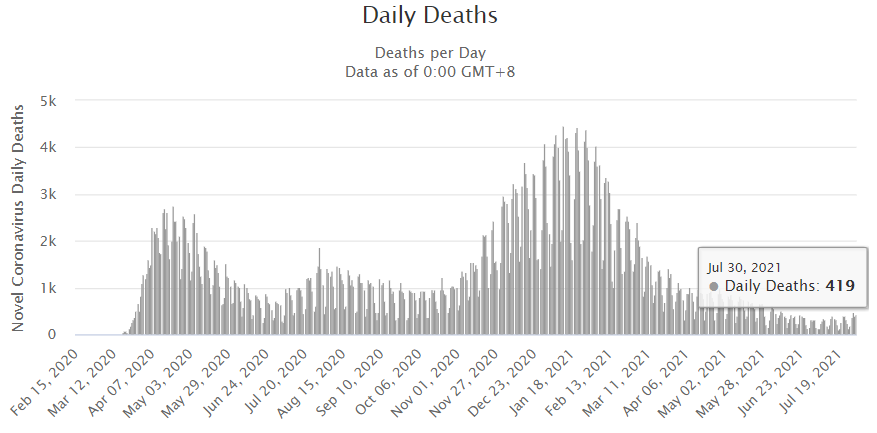

Once again, COVID is front and center as we watch the delta variant moves through the country with daily new cases approaching one hundred thousand, a level not seen since the winter. Economists and investors are trying to parse through the data and cogitate the repercussions. The headlines are unnerving, but the daily deaths remain at the lowest levels since March of last year. If you’re interested, Public Health England has a comprehensive report about the impact of the delta variant in the UK. The delta variant sounds ominous, but the virus appears to be less deadly than the previous mutations. Isolating the unvaccinated population, there were 92 deaths out of 71,932 cases or a mortality rate of about 0.13%. This is positive news, but it does not condone those who are not vaccinated. Almost 60% of the cases were amongst the unvaccinated population, which is saying a lot for a country that has vaccinated almost 90% of its population. Perhaps the true winners during these Olympics are Moderna, Pfizer/BioNTech, J&J, and AstraZeneca.

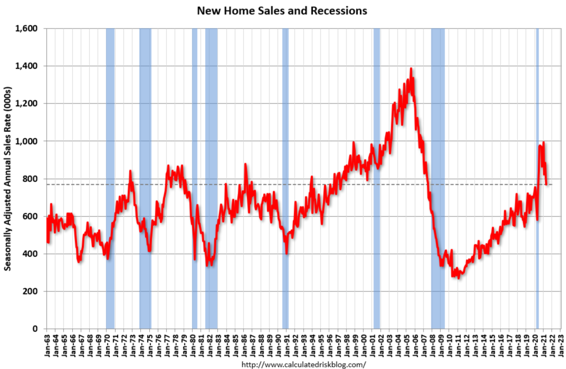

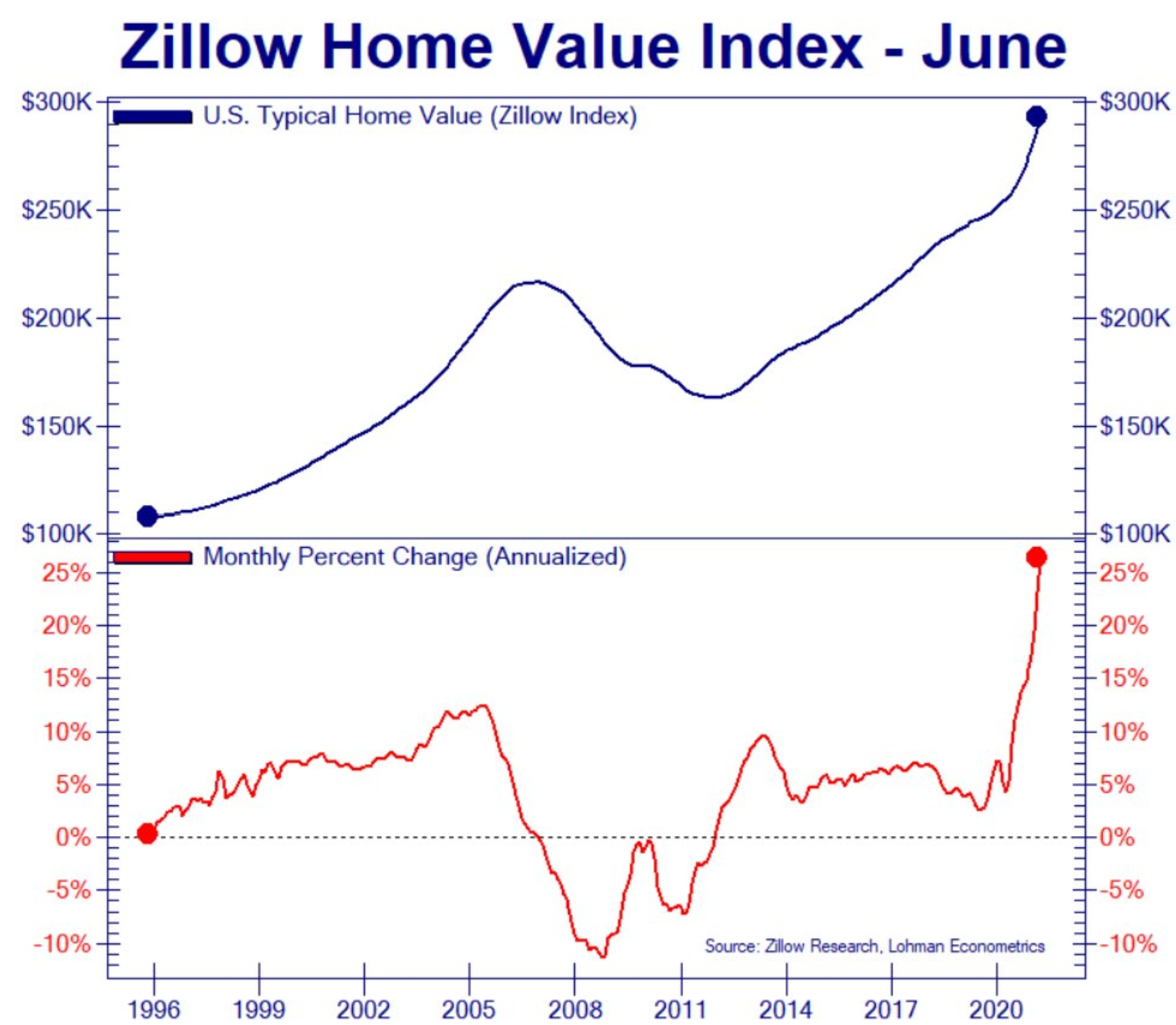

This month, the National Bureau of Economic Research declared last year’s recession officially ended on April 30, 2020, lasting just two months. Of the 18 recessions we have experienced in the past century, this was easily the shortest. The average recession lasted 13.6 months (National Bureau of Economic Research). Truly astonishing considering this was the third-worst recession in the past century, only surpassed by the Great Depression and the recession following WWII. The abrupt reversal coincided with an exorbitant rally from the stock market and just about every other asset. Look around you - everything has been hot, hot, hot! Home prices are up almost 17% from last May (Case Shiller National Price Index), the stock market is up over 15% on the year, and 100% from the March lows, companies in the S&P 500 are reporting the highest year-over-year growth rates in earnings going back to 2009, and economic growth is following the same path as the rockets carrying two billionaires into space.

Last summer, clients asked why the market isn’t falling as the economic numbers looked dire? Professional investors know the market responds to the rate at which the data is changing and not the level. Even though the fundamental data was negative, the data became less negative as we moved into the summer. Today, we see hot numbers everywhere we look. If the numbers are less positive, should the same logic apply? “Peak growth” has become the latest boogeyman in markets. That’s the buzzy phrase used nowadays in discussing the rate of change in corporate earnings, U.S. gross domestic product, stock prices, government and central-bank stimulus, and inflation. The delta is not the growth rate but the change in the growth rate. It’s the trend that matters for investors, and the outlook is moving toward a deceleration on several of those fronts.

I already mentioned the exorbitant GDP and earnings growth we are witnessing. Second-quarter GDP rose 6.5% over the previous year, and second-quarter earnings are expected to increase 89.8% in the US as of July 30, 2021 (Refintiv) and 115.2% in Europe (Stoxx 600) from Q2 2020 (Refintiv). With this positive news, why has the stock market been stuck in such a tight trading range? Simple, investors are watching the delta of these numbers and not the headline number. In other words, is the growth accelerating or decelerating (i.e., peaking)? Have we reached peak earnings and GDP? No, but we may have just witnessed peak earnings and GDP growth - and that is what investors care about.

Goldman Sachs has downgraded their growth forecasts stating, “The subsequent deceleration now looks likely to be a bit sharper because the goods-to-services rotation is likely to be less seamless…We expect growth to slow further to a trend-like 1.5-2% by 2022H2, a sharper deceleration than consensus expects.” Consensus estimates are usually baked into stock prices. The market moves when data is better or worse than the consensus. For example, early in 2020, most of us knew about the COVID outbreak in China, but the stock market did not fall as the consensus assumed it would not reach our soil or turn into a pandemic. Reality proved worse than expected, and the market fell. After the market bottomed on March 23, 2020, the consensus was that the pandemic would cripple the global economy, and it would take a while to return to trend-like growth. The consensus underestimated the resilience of the US economy, and the stock market rallied as growth was ahead of investor’s presumptions. The Citi Economic Surprise Index provides a graphical depiction of whether the economic data fares relative to expectations. If the graph slopes upward, the data is coming in stronger than consensus estimates, a positive signal. As you can see, the data was far worse than expectations as we entered the pandemic and far better during the recovery. What about today? The Economic Surprise Index is squarely in the middle of the range, but the graph is sloping downward. Last week, GDP growth was strong in the second quarter, but it was supposed to be higher by about 2%. Developments like this will exacerbate the decline of the Economic Surprise Index. On the professional side of money management, some focus on stocks/equities, and others specialize in bonds/fixed. The premonitory signal from bond investors implicates muted returns for equity investors.

While everyone seems to be concerned about an economy running too hot, bond investors are signaling lethargic growth. I've always thought bond investors are smarter than their equity counterparts. If they're right, it means inflation will be superficial or economic growth will halt. Only time will tell. If we overlay a chart of bond yields on top of the Economic Surprise Index, we notice the clear correlation between bond yields and the Economic Surprise Index. But why? When investors are concerned about the stock market producing lackluster returns, they move to bonds. With bonds, prices and yields are inversely correlated. When demand for bonds increases, investors pay more for the bonds and yields come down. In the chart, yields fall before the Economic Surprise Index falls. Clearly, bond investors have keen discernment about the state of the economy. Since April, the yield on the 10-year treasury has fallen about 0.50%. Is the bond market providing acumen about the direction of economic growth? Perhaps.

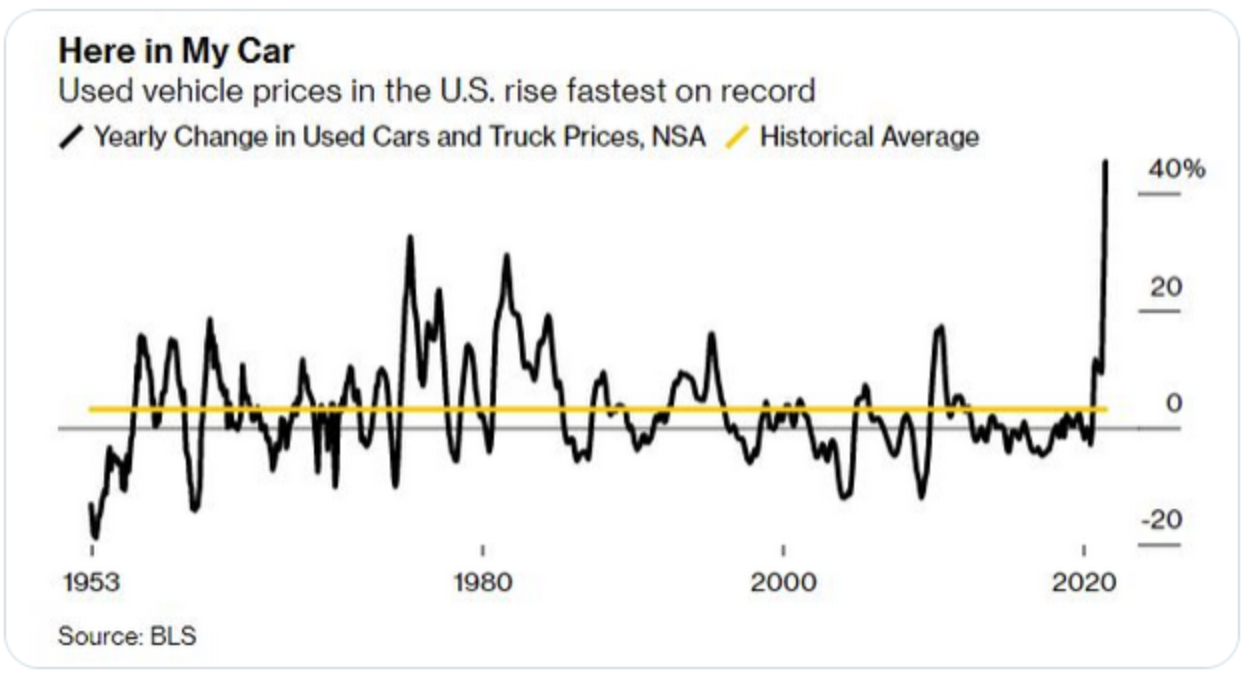

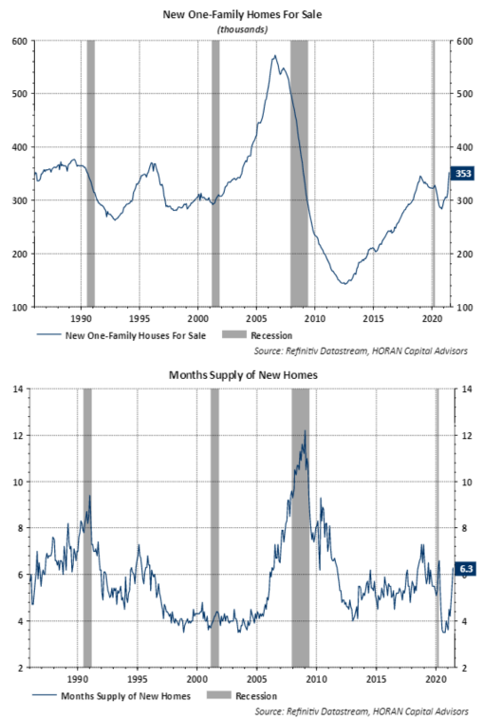

As the rate of growth for corporate earnings, the economy, and a myriad of other factors wane. Discerning individuals do not expect the continuation of used car prices skyrocketing, home prices appreciating double-digits, and the stock market averaging more than 13% per year. I do not expect things to come crashing down. Everything is still great…but perhaps less great.

Noble Wealth Pro Tip of the Month

Sell Your Used Car - Wait, Sell Everything…

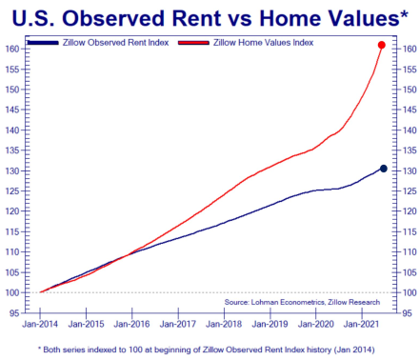

Used car prices rose at the fastest pace on record. If you have an old car you no longer need, now is the time to consider selling. In fact, now may be the time to sell all your excess property. If you’re apathetic about your second home, consider selling - monthly home prices just rose at a faster clip than during the housing bubble.

Past Performance Does Not Indicate Future Results

The human habit of pretending that a rearview mirror is a crystal ball is almost incorrigible.

On the behavioral psychology theme, Jason Zweig with the Wall Street Journal wrote a great column on investor behavior regarding past performance. In a new study in the Journal of Experimental Psychology, 1,600 participants were asked to choose between two funds. Fund performance was random, and participants chose the fund with lower expenses in general. Strikingly, when many investors viewed the standard mutual-fund disclaimer that “past performance does not guarantee future results,” they chose the fund with higher fees more often. The results are fascinating, and they explain why some people pick funds with the best performance even when they are told not to. They assume “they know better” and incorrectly conclude this advice does not apply to them.

The phrase “does not guarantee future results” may cause investors to conclude—erroneously—that past performance is nonetheless a highly reliable indicator.

Social Security Benefits Are a Great Inflation Hedge

Social Security benefits have a built-in hedge for inflation. Every year, recipients get a bump in their payments tied to COLA (cost of living adjustment), and great news - these COLA adjustments are tied to inflation which is increasing at the fastest pace since 2008. In October, the Social Security Administration will announce the increase in Social Security benefits due to the increase in the cost of living. This one is expected to be 5.3%, the largest since 2009. COLA is based on CPI, which has a 42.1% weight for housing. However, the Federal Reserve measures inflation using the Personal Consumption Expenditures index, which only gives housing a 22.6% weighting. Housing prices have been on a tear lately, and it could mean good news for those relying on Social Security benefits. The inflation hedge is exacerbated for those that have, or are willing to, delay their benefits. Individuals receive an 8% increase in the benefits for every year they defer. If you are unsure when to take your benefits, please evaluate deferring your benefits until age 70.

Interesting Findings

Over the next 10 fiscal years (2022 through 2031), the US government is projected to receive $51.3 trillion of tax revenue while spending $63.4 trillion. Net result? A $12 trillion increase in the deficit over the next decade (CBO). These are ominous projections unless the government snagged a pair of red shoes from the Wizard of Oz - tap the heels together three times, and it will all go away 🙏

Despite 9.5 million jobless Americans as of June 2021, 3.99 million Americans quit their jobs in April 2021, the largest monthly “quit level” in US history (Department of Labor).

If the total net worth of all Americans ($136.9 trillion) were evenly divided among all households in the nation (125.9 million), then every household in the U.S. would have been worth $1.1 million as of 3/31/21 (Federal Reserve).

In the Tech Bubble, the S&P 500 peaked on 3/24/2000, fell 47%, then gained 121%, then lost 55%, then gained 529%, then lost 34%, and then gained 94% through 6/11/2021. Those investors that bought at the peak in 3/24/2000 had 7% annualized returns despite buying at the high.

Wives who survived their husbands (a 62% probability) lived 12 to 14 years on average before dying. Men who survived their wives (a 38% probability) lived nine to 11 years.

The 10-year budget forecast released by the Biden White House on 5/28/21 predicts that over the next decade (fiscal year 2022 through 2031), the government will collect $54.7 trillion in tax revenues (i.e., “receipts”), spend $69.2 trillion (i.e., “outlays”), netting to a $14.5 trillion deficit created over just the next 10 years. That’s on top of our national debt of $28.2 trillion as of 5/31/21 (source: Biden White House).

When America recorded 4.32 million births in 2007, it broke the nation’s all-time high of 4.31 million births from 1957. Since 2007, the number of US births has fallen in 12 of 13 years to 3.61 million births in 2020, the same number of US births that took place in 1980 (source:

Centers for Disease Control and Prevention).

Colorado was the 1st state, beginning its legal sales on 1/01/14. From its inception through 4/30/21, Colorado has collected $1.56 billion of state tax revenue from cannabis sales (source: Marijuana Policy Project).

Tuition at America’s public universities has nearly tripled since 1990. The Federal Reserve Bank of Richmond says 54% of tuition price rises from 1987 through 2010 were due to the increase of federal financial aid. Much of the change stemmed from the legislative change in 1993 to allow unsubsidized federal loans.

The Richest 25 – pay less in taxes, an average of 15.8% of adjusted gross income, than many ordinary workers do, once you include Social Security and Medicare. Amazon founder Jeff Bezos paid no income tax in 2007 and 2011. Tesla founder Elon Musk’s income tax bill in 2018 was zero, and financier George Soros went three straight years without paying federal income tax (ProPublica).

Things We’re Reading and Enjoying

Deep Work: Rules for Focused Success in a Distracted World | Cal Newport

Deep Work is all about how the rise of technology has wrecked our ability to concentrate deeply on tasks - and how you can overcome this blockade. In short, deep work is like a superpower in our increasingly competitive twenty-first-century economy. And yet, most people have lost the ability to go deep-spending their days instead in a frantic blur of e-mail and social media, not even realizing there's a better way.

Multipliers | Liz Wiseman

Multipliers examines the difference between good leaders, known as multipliers, who can join any team and make it flourish, and bad leaders, known as diminishes, who can drain any team of its energy and desire. This book compares skills you should strive to develop and those you should avoid at all costs.

Getting Naked | Patrick Lencioni

This book is about vulnerability and the incredible power it holds. It will explain how to build trust with clients and overcome the three most common fears that prevent you from showing your true vulnerability.

The Lord of the Roths | Justin Elliott, Patricia Callahan, and James Bandler

Find out how Peter Thiel grew his Roth IRA to over five billion dollars. Billionaires are using Roth IRAs as a safe haven for taxes to grow their net worth. These billionaires are bending the tax code to invest in privately-owned companies with massive upside potential.

Over the last 20 years, Thiel has quietly turned his Roth IRA — a humdrum retirement vehicle intended to spur Americans to save for their golden years — into a gargantuan tax-exempt piggy bank, confidential Internal Revenue Service data shows. Using stock deals unavailable to most people, Thiel has taken a retirement account worth less than $2,000 in 1999 and spun it into a $5 billion windfall.

Noise | Daniel Kahneman

In Noise, the authors show the detrimental effects of noise in many fields, including medicine, law, economic forecasting, forensic science, bail, child protection, strategy, performance reviews, and personnel selection. Wherever there is judgment, there is noise - and more of it than you think. For example:

People in a good mood are more biased than they would otherwise be.

Deliberating juries have results that are more extreme than even the most extreme member of the jury.

Yet, most of the time, individuals and organizations alike are unaware of it. They neglect noise to the detriment of the business. With a few simple remedies, people can reduce both noise and bias and make far better decisions.

Finally, Some Light Humor as We All Get Older

Until next month,

-Your team at Noble Wealth Partners

“There is nothing noble about being superior to your fellow man. True nobility is being superior to your former self.” Ernest Hemingway