NWP Monthly Digest | February 2021

Just when it seemed like the world couldn’t get any more unpredictable, it did! Both the end of 2020 and the beginning of 2021 have given me a sustained aneurysm, not to mention the fact that I’m about to be a father! I know what you’re thinking: In this time? In this economy?! As I try to wrap my head around it, both professionally and personally, I can’t help but reflect on the wild events of the recent past and what’s in store for us in the future (besides what’s in store for me – diapers). Read to the end because I’ve also thrown in some advice for stable, sound investing even when the world around you isn’t.

Horrible Economy? Depends on Who You Ask?

In late 2020, our most popular question was asking:

“Why on Earth does the market continue to rise despite the worst economy since the Great Depression?”

First, we entered a K-shaped recovery where those impacted by the pandemic are not those with the excess savings to invest. Second, the makeup of the economy is vastly different from the composition of the stock market. For example, government, agriculture, and miscellaneous services account for 36% of employment (as of November 2020), and technology is only 2% of employment. However, technology makes up 38% of the stock market (December 2020), and government, agriculture, and miscellaneous services account for 0% of the stock market. In other words, GDP is not the S&P. Finally, when the Fed started printing money, the stock market heard the message loud and clear and has not looked back since the lows in March. Subsequently, IPOs took note of investors’ willingness to take risks, and in 2020, 343 IPOs came to the market – the highest number since 2000 (stockanalysis.com). IPOs in the 4th quarter of 2020 (Airbnb, DoorDash, McAfee) continued to pique the interest of investors who sought sizable returns quickly. All of this adds up to a desire for extraordinary capital gains that is both intoxicating as well as reminiscent of the late 1990s.

But it didn’t stop there! Next up: the SPACs (special purpose acquisition companies), which are essentially blank check companies. Investors purchase these SPAC companies, which take the proceeds and then try to acquire or merge with another firm. When speculation is the name of the game, it’s a perfect environment for SPACs to show up, and boy did they. The previous record issuance was in 2007, but 2020 blew that record out of the water, and 2021 is off to another record-breaking year.

Rise of the Retail Investors

“Buying what’s ‘hot’ is not investing, it’s gambling!” Peter Lynch

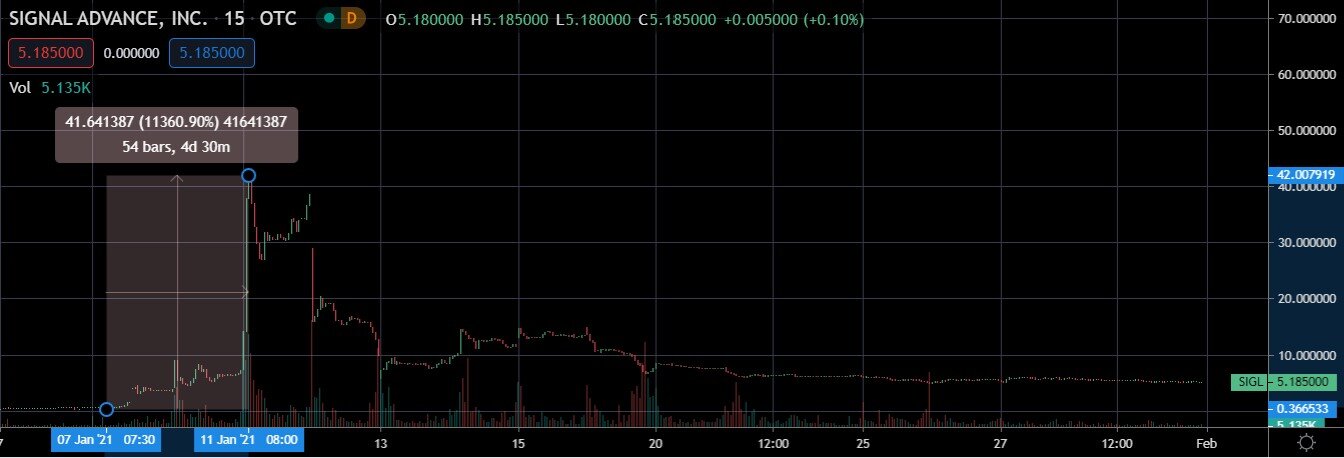

There are several examples of the retail investor trading on a whim. In early January, Elon Musk published the tweet, “Use Signal,” referring to the encrypted messaging service that is not publicly traded. Investors then bid up the price of Signal Advance (ticker symbol SIGL), an unrelated biotech company. The price rose over 11,000% in one day before crashing back down.

The prequel to retail investor trading may have been Bitcoin, which is roaring back at the moment. I understand the appeal of the blockchain and virtual currency, especially to those who lack trust in central banks, and I like the idea of moving away from fiat currency. However, currencies must be inflationary to function properly in our system, not deflationary. In other words, it cannot appreciate in value if it is to be widely adopted. Imagine a bank giving you a mortgage in Bitcoin worth $500,000 in January of 2019 – today, you would have to pay the bank around $5 million or face foreclosure. If Bitcoin is deflationary and designed to appreciate over time, it will never replace traditional currencies. If it never replaces other currency, we cannot think of it as money, and we must instead think of it as an investment. If it is an investment, how much is it worth? Technically, it is worth what someone is willing to pay for it. But remember, it pays no dividends or cash flow; you cannot hold it; therefore, it is technically worth nothing. One of the best investors of our time, Jeremy Grantham, summarized it perfectly:

“Bitcoin’s entire value is on the greater fool.” Jeremy Grantham

Investors would be wise to listen to his words. He did call the Japanese Stock Bubble, the Dot-Com Bubble, and The Great Recession. Even though I am presenting an argument against the crypto-currency, I am comfortable with clients owning less than 5% of their portfolio value in Bitcoin to hedge against the possibility that myself and other professional investors like Mr. Grantham are wrong. If it is a bad trade, but it decreased the risk in your financial plan, is it the wrong move? I think not.

The SPAC and IPO issuance and Bitcoin trading are a natural result of stockholders' impetus to throw their savings at almost anything resulting in a market dictated by euphoria. According to the Citi Panic/Euphoria model, we have hit the third highest reading of euphoria going back to the 1990s, all of which has led to the meteoric rise of non-professional investors who are not associated with an investment firm. Market pundits call these people “retail investors,” whose recent activity has led to more than half a trillion dollars' worth of options on individual stocks traded on Jan. 8 alone, the highest single-day level on record, according to Goldman Sachs Group analysts in a Jan. 13 note.

Stock Tips From a “Degenerate?”

On Reddit, there’s a group by the name of Wall Street Bets with over six million members, or as they like to be called, “degenerates.” The community has targeted the most heavily shorted (i.e., betting the stock will fall) stocks in the Russell 3000. They claim they are trying to take down Wall Street and win one for the little guys. What’s my perspective? It is reasonable to take the opposite side as a hedge fund manager, as long as they understand they will not be “taking down Wall Street.” Melvin Capital lost 53% in January and have been receiving emergency funds from other hedge funds and Citadel LLC, the high-frequency trader which ironically pays Robinhood for sending them customer orders – do you see a conflict here? The harsh reality is that if the hedge funds go under, they will close down the fund and start a new one - rinse and repeat. Hedge funds have been underperforming for the better part of the last two decades and still manage to find new investors.

But why Gamestop, AMC, and American Airlines?

I believe there are two scenarios. In the first, the investors in the group understand the profit potential when betting against these short bets on the names (even in this scenario, most followers will not be profitable).

The far more likely scenario is that they are buying names that have been beaten to death, knowing that hedge funds are betting on their failures, yet without understanding the company's financials and the true risk of bankruptcy. My opinion is the original holders of Gamestop understand the asymmetry of returns possibilities when they established their position. These individuals borrow the stock at today’s price and agree to pay it back later, which means they will have to buy the stock in the future to make good on their promise. If the stock declines, they win, and they can capture the difference in prices as profit, known as shorting the stock. With these names, an enormous percentage of the stock was held short. However, when a group of over six million members agrees to buy a stock, it will surely push the price up. When that happens, some of those short positions will decide they made the wrong call, and they will cut their losses, buy the stock back, and close out their position; driving the stock up in what traders call a “short squeeze.” Those following the group found a solid name to buy, and they follow suit, and the price goes up. More shorts close their position, the price goes up again. And the reinforcing feedback loop continues — Gamma Squeeze.

Sticking It to the Man

Again, I understand these investors' altruistic mindset, and it’s appealing to make a quick buck, but I am apprehensive about the situation as it develops. Are these traders aware they are not the first generation or group of traders to attempt this? Look up the grocery chain Piggly Wiggly and what happened to the founder Clarence Saunders in 1919. There are countless examples throughout history, and Wall Street is still standing. What makes the retail investors think their credulous approach will be more successful than professional investors? Would you win a tennis match against Federer? What if you had the help of everyone on Reddit? Still no – then stop trying! Especially when your hard-earned savings are on the line. If you and your friends had a 7-2 off suit at a poker table and were able to talk and say, “let’s try to get all the other players to fold.” You may get them to a few times, but eventually, you will lose. Recognize, you are the gambler that just won on the slot machine, and the casino knows you will lose over the long run.

That being said, I want to highlight the underlying frustration and anger toward the financial system that fuels many “degenerates” on Reddit – and their feelings are legitimate. Frankly, it’s no wonder that history has numerous examples of groups trying to take down the system. The permanence of the stock market, combined with its bias toward wealthy investors, is by all measures unfair. The cards are stacked against the retail investor, not just because of their inexperience but because of their lack of resources. Ultimately, sports remain a provocative metaphor – countries that perform well at the Olympics are generally quite wealthy or dedicate enormous resources to their programs. While the system may have its glaring shortcomings, the solution probably won’t come from a Reddit group.

All “Good” Things Come to an End

To the retail trader, this period of euphoric behavior is bliss. Meanwhile, savvy investors begin to worry about the next bubble. Bull markets don’t die of old age, they die from excesses, and the euphoria in today’s market is pure excess.

“If shoeshine boys are giving stock tips, then it’s time to get out of the market.” Joe Kennedy

Yes, the antiquated quote from JFK’s father before he sold out of the stock market in the summer of 1929 and made a “killing” still holds nearly a century later. In the Dot-com Bubble, taxi drivers gave stock tips. Perhaps this time, it will be the users on Reddit. Only time will tell…

There’s No Silver Bullet

The allure of investing in “opportunities” with aggrandizing return potential within a short time frame becomes more powerful as we read about individuals who have been successful investing modest sums and converting them into six or seven-figure outcomes. Perhaps we can relate to what these individuals have accomplished, believing we are equally talented and prescient. However, it is worth remembering that headlines attract readers, but they don’t do a particularly sound job of helping us prepare for retirement or pay down debt. Most individuals are disappointed with the results from “get rich quick” ideas or, worse, lose a substantial portion of their original investment. Frequently, these unsatisfactory outcomes are the result of “herd mentality” and overconfidence bias.

Many investors are excited to kickstart their journey as a stock-picker of a portfolio manager. Those lucky investors that hit home runs with their first pick may be the least lucky investors of all at the end of the day. New investors tend to display overconfidence bias, and this bias is only exacerbated with every successful investment. The bets get bigger and bigger – and eventually, their wealth is destroyed when they realize they have a lot to learn. To avoid adding overconfidence fuel to the fire for those jumpstarting their investment endeavors, let me outline the four stages of becoming an investor. My goal is to help you break the cycle and to speed up the learning curve to save you time…and money.

The Four Stages of Becoming an Investor

PICK UP THE RACKET AND LEARN THE GAME

Like Roger Federer holding his first racket, your path to becoming an investor will begin with you discovering the existence of investing assets. Is this something that interests you? If not, this may not be for you. Once you are aware of investing, you would be wise to learn the basics, learn the language, read Wall Street Journal or any investing publication. Take classes and educate yourself before testing the waters – if you aren’t ready to begin investing, the consequences can be dire, just as returning a 140mph serve on a tennis court would be if you had never stepped foot on one.

As Federer started to compete in tennis, he had to decide if his strengths were to serve-and-volley or slug it out from the baseline and grind out points. Federer had to discover what type of tennis player he was going to be based on rules, traditions, trends, opponents, and his own talent. Similarly, you must decide what type of investor you want to be which will shape your path. Do you want to buy and sell positions daily? Will you use derivatives? What about a boring buy-and-hold value investor? The average investor tends to blur the lines between investor types. A day trader has vastly different goals and they target different securities than a buy-and-hold investor. At Noble Wealth Partners, we are tactical asset allocators and our targeted holding period for individual securities is between one and five years. Our goals are a stark contrast to those of Gamestop investors. If you are wondering if we considered the Gamestop, AMC, Blackberry, etc. trades – the answer is a firm no.

POLISH YOUR SKILLS

Federer’s unprecedented accuracy and footwork may have started with talent, but required enormous dedication, practice, and learning from mistakes. At this step, you know what type of investor you will be. Now, you, too, must learn more and practice.

Did you decide you were going to be a day trader? Proceed with caution, but if this is what you are seeking, your targeted holding period is less than six months with the securities you own. Your stock analysis should focus purely on sentiment and technical price patterns of the stock. Is the news improving or deteriorating? Look at price and volume patterns on the stock. These indicators will be a better predictor of returns for you than price multiples and valuation metrics.

This is a great segue into what matters to value investors. Value investors will spend a significant amount of time (far more than day traders) performing diligence on an investment – tearing through the financial statements to evaluate if the stock is cheap. These investors must have holding periods of at least a year. Buying stocks at attractive relative valuations can be a profitable strategy – just look at famous investors like Warren Buffet and Peter Lynch – but the valuations alone are no indicator of performance over short periods. Over long periods (more than five years), valuation is one of the strongest predictors of future returns.

This approach extends to asset classes and regions as well. The U.S. stock market is one of the most expensive markets in the world, and that does not bode well for future returns. I can confidently say returns over the next 20 years should be comfortably positive but significantly lower than what we have seen in the past two decades. Unfortunately, these valuations mean nothing when forecasting the returns over the next three years.

Finally, and critical to this step is understanding you must judge outperformance within the context of the risk taken to pursue your strategies. If you made 100% in Bitcoin, did you outperform a bond paying an interest rate of 5% (if you can find one)? In this example, Bitcoin’s returns were 20x that of the bond, but if the risk was 20x greater, the bond outperformed. With hindsight, almost all the readers would say they would prefer Bitcoin’s returns, but if you had to experience those returns, lying awake at night, question if your financial plan is healthy, and so on, many would prefer the consistency and stability of the return on the bond.

Congratulations - you have graduated to what we like to call the “knowing enough to be dangerous” category of investors.

BECOME A CHAMPION

In 2003, a 21-year-old Federer was already one of the top players in the world. As we already know, it took hard work, dedication, and a desire to be the best, all of which paid off when he won his first-ever Grand Slam at Wimbledon that same year.

As you become an investing champion, you must adapt to a changing environment, exercise patience, and stay pragmatic and true to your approach. If you want to make several trades a day, recognize you are gambling even if the odds may be in your favor. Do not dwell on one bad bet. Play your percentages, learn from your mistakes, and trust your intuition. Dr. Michael Burry (from the Big Short), was correct with his assertions about the housing market. However, his investors and market forces nearly induced him to sell his position before profiting. Can you stay solvent long enough to recognize the value from your positions? Savvy investors know buying a cheap stock does not mean you will make money if you can’t ride out intermittent volatility.

The stock market can stay irrational longer than you can stay solvent.

In this phase, you should also self-reflect. What am I missing? Does the market know something I don’t? I’ve heard colleagues in the past say, “the market is stupid.” Meanwhile, the stock market clearly knew something we didn’t. I gave the market credit and began researching what we were missing. In this example, it pertained to master limited partnerships. General knowledge around the investment community held out that these contracts were like toll roads, insulated from the price of oil.

At the same time, the financial statements of these companies told a different story. My colleague at the time had been investing since the late 1990s – experience was not the issue – rather it was a lack of humility and the self-awareness to accept the possibility you are wrong, which are derived from ignorance in its purest form and can be costly for your clients.

All investors have biases. Learn these biases and how to overcome them to avoid a painful loss in the future. Common biases for all investors are: overconfidence bias, hindsight bias, recency bias, familiarity bias, status quo bias, and the list goes on. Stay pragmatic, open-minded, and don’t let your emotions get the best of you.

MASTER THE GAME

You can master investing once you accept that you can never master investing – not so different from tennis or any sport, physical constraints notwithstanding. At the age of 33, Federer changed rackets for the first time in his career to one that was 97 square inches (instead of 90). Since the racket change, Federer has dominated the head-to-head matchup against Rafael Nadal 7-2 after switching rackets, despite being five years older than Nadal. Conversely, before the racket change, Nadal had dominated Federer. Recognizing you have a lot to learn is a critical step in becoming an expert in any field.

Professional investors may accept their strategies are no longer profitable. Value investors have underperformed for the better part of this cycle. Those staunch value investors would have been wise to accept the changing investment regime and acknowledge the merit of holding growth companies in your portfolio, like Microsoft, Apple, and Amazon. The worth around you is changing, and so should your portfolio. Don’t be so hard-headed you are unwilling to make adjustments along the way.

Noble Wealth Pro Tip of the Month

Early retirement can be a sticky issue if you have been loading up your employer’s retirement plan. All is not lost if that is you; there are options if you are proactive in your approach. Grant Glenn was recently quoted in Barron’s magazine as he provided his opinion on the subject. Understand, there are vital issues with each approach. Be sure to discuss the nuances with a competent professional to help you lay out a plan to achieve your goals

Things We’re Reading and Enjoying

The Long View | Brian Fetherstonhaugh

The Long View offers highly practical exercises that challenge you to rethink how to assess your skills, invest your time and expand your personal network, and provides a framework for facing tough job decisions. With insights drawn from interviews with a variety of professionals―who share both success stories and cautionary tales―The Long View will help you establish your own path for overcoming obstacles and making the best choices for a long, accomplished, and rewarding career.

Home Game | Michael Lewis

In my pursuit toward fatherhood, I was looking for a book to help me prepare and know what hurdles to expect. I know anyone can provide their thoughts, but I love the way Michael Lewis writes and he usually tells great stories that are fun to follow along with. This book was everything I thought it would be and I’m happy I had the chance to read a timeless story from Mr. Lewis about parenting.

I’ll Invest When The Dust Settles | The Compound Show with Josh Brown

No, this isn’t a book but I bet some of you will love this podcast episode. In this episode, Josh discusses those famous words we hear from investors, “I’ll invest once the dust settles.” As we have learned, the market is forward-looking. Once the dust settles, the opportunity is gone and it is too late. During the financial crisis, the stock market bottomed in 2009 but the housing market did not bottom until 2011. This year, the market bottomed in March but COVID is far from over (as we know). Josh does a good job of explaining why investors should not wait until the dust settles. After listening to the podcast, those of you guilty of waiting until the dust settles, remember his words and it may help you once we see opportunities in the market. Josh is joined by Nicholas Colas (DataTrek Research) to discuss the current stock market opportunities around the world, from the US to Europe to Japan to the Emerging Markets. We get Nick's take on autonomous vehicles, Chinese tech giants, and some of the things he's learned from 30 years on Wall Street.

One Up On Wall Street by Peter Lynch

Until next month,

-Your team at Noble Wealth Partners

“There is nothing noble about being superior to your fellow man. True nobility is being superior to your former self.” Ernest Hemingway